The Operating Week | 8.29.25

AI’s Shifting Sands, Consumer Caution, and a Revolution in College Sports

This Week in Brief

A quick digest of the week’s major events and trends:

Economy & Politics

Tariffs Expand: The U.S. ended the de minimis exemption for imports under $800, imposing flat duties of $80–200, raising consumer costs.

Consumers Go Thrifty: Spending stagnated in H1 2025; bulk buying, couponing, and generic brands are on the rise.

Fed Under Fire: President Trump attempted to fire Fed Governor Lisa Cook, escalating pressure on the central bank. Powell signaled a possible September cut.

“Patriotic Capitalism”: The U.S. confirmed a 10% equity stake in Intel ($8.9B) under the Chips Act.

Created with TradingView Immigration Decline: Net immigration could turn negative, reducing labor supply and growth by 0.2–0.3pp in 2025–26.

Corporate Governance: Texas passed laws favoring executives over shareholders, seen as a regulatory “race to the bottom.”

Technology & AI

AI Plateau: Meta’s Llama 4 and OpenAI’s GPT-5 face delays; Altman warns of overexcitement.

OpenAI Open-Sources Models: Released gpt-oss-120b and gpt-oss-20b to compete with Meta and DeepSeek.

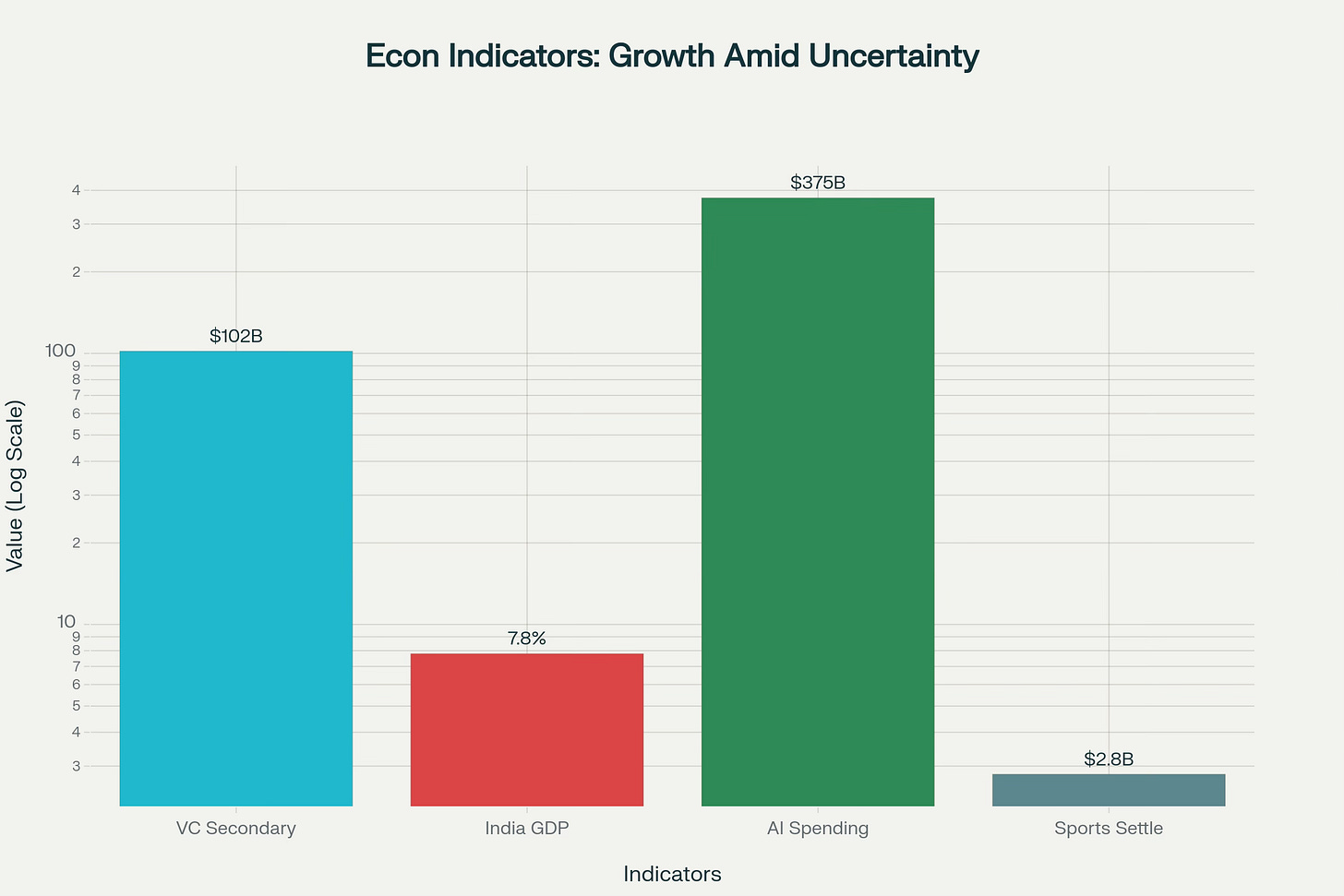

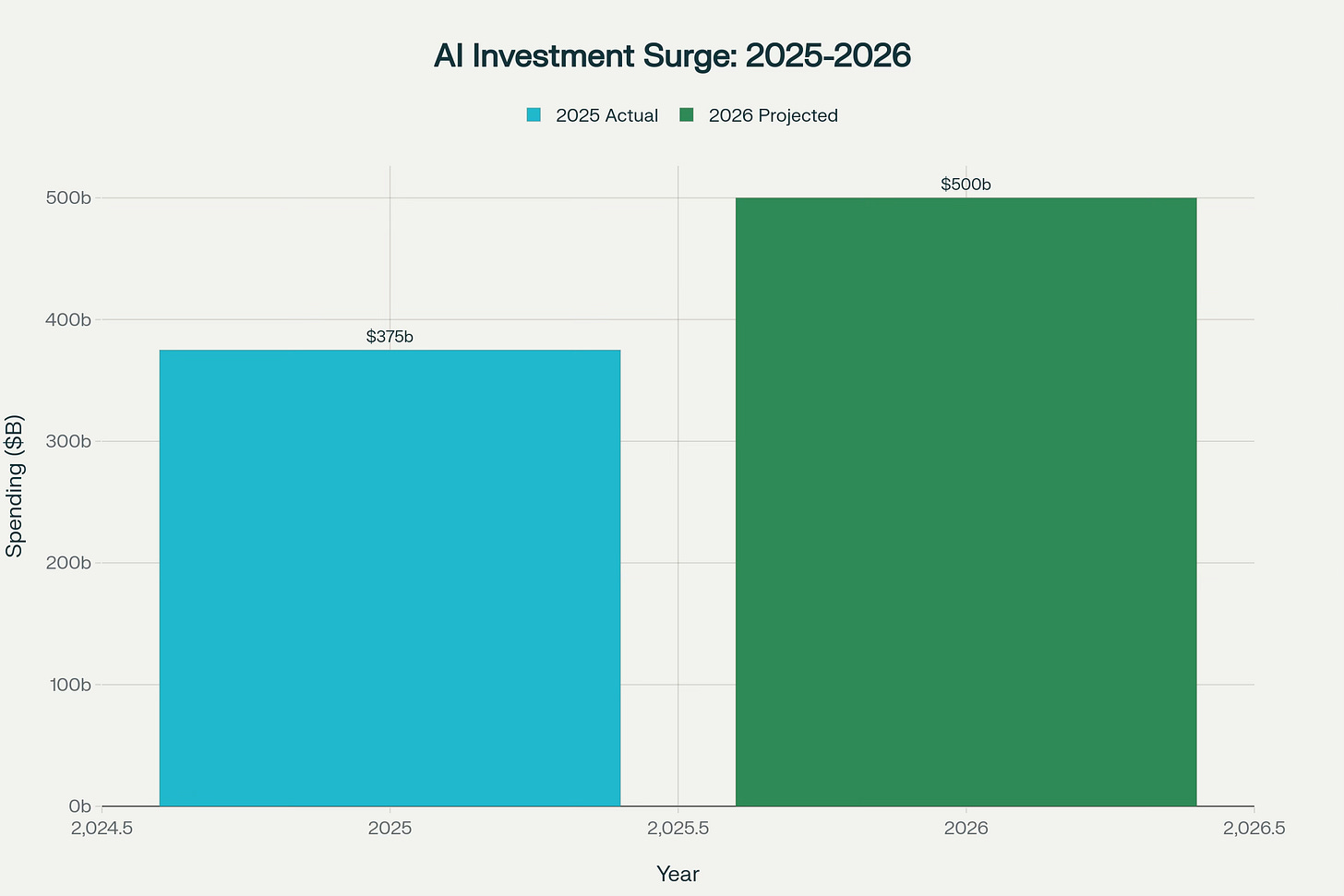

AI Spending Surge: $375B spent globally on AI in 2025; $500B projected for 2026.

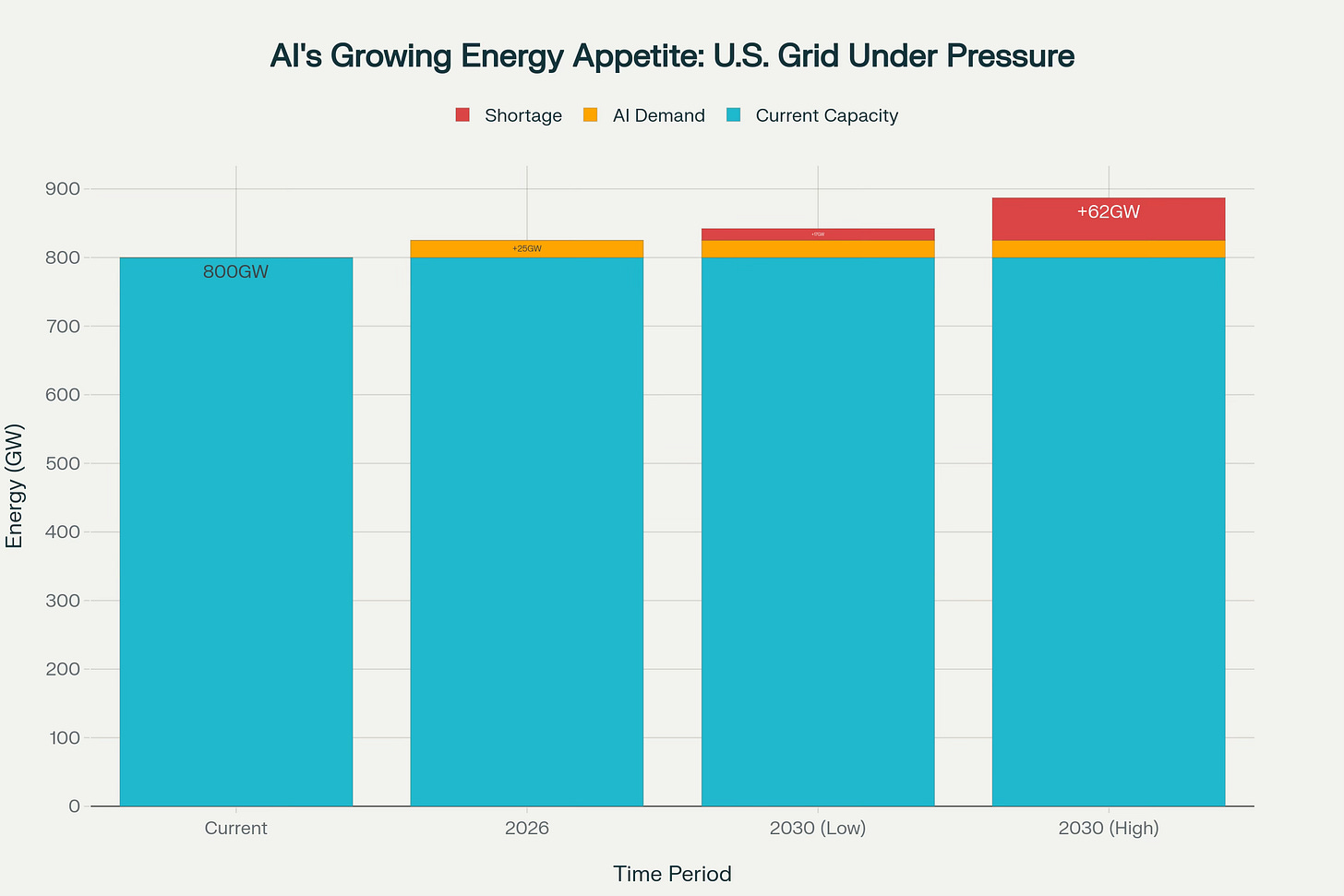

Nvidia’s Power Challenge: Record sales ($47B), but America’s grid may not sustain AI demand, risking shortages of 17–62GW by 2030.

Jobs & AI: Stanford study shows entry-level jobs shrinking, augmented roles expanding.

Legal Fights: Elon Musk’s xAI sued Apple and OpenAI for anticompetitive practices.

Google’s Pixel 10: Advanced AI tools (translation, camera coach, fitness insights) push it ahead of iPhone in AI.

Europe vs. China: Europe’s digital sovereignty push faces criticism, while China’s DeepSeek and Alibaba advance with Huawei chips despite overheating issues.

AI Adoption Struggles: Taco Bell scales back voice AI after glitches and trolling at 500+ drive-throughs.

Other Developments

College Sports Shift: NCAA settlement allows $20.5M direct payments to athletes, ending amateurism.

VC Secondary Market: $102B traded in H1 2025; SPVs and tokenized stocks raise risks for founders and investors.

Biohacking Hub: Montana positions itself as a U.S. center for longevity and experimental medicine.

Milan’s Expat Boom: Italy’s tax regime attracts wealthy foreigners, straining housing.

India’s Growth: Q2 GDP rose 7.8% YoY, but new U.S. tariffs triggered rupee lows.

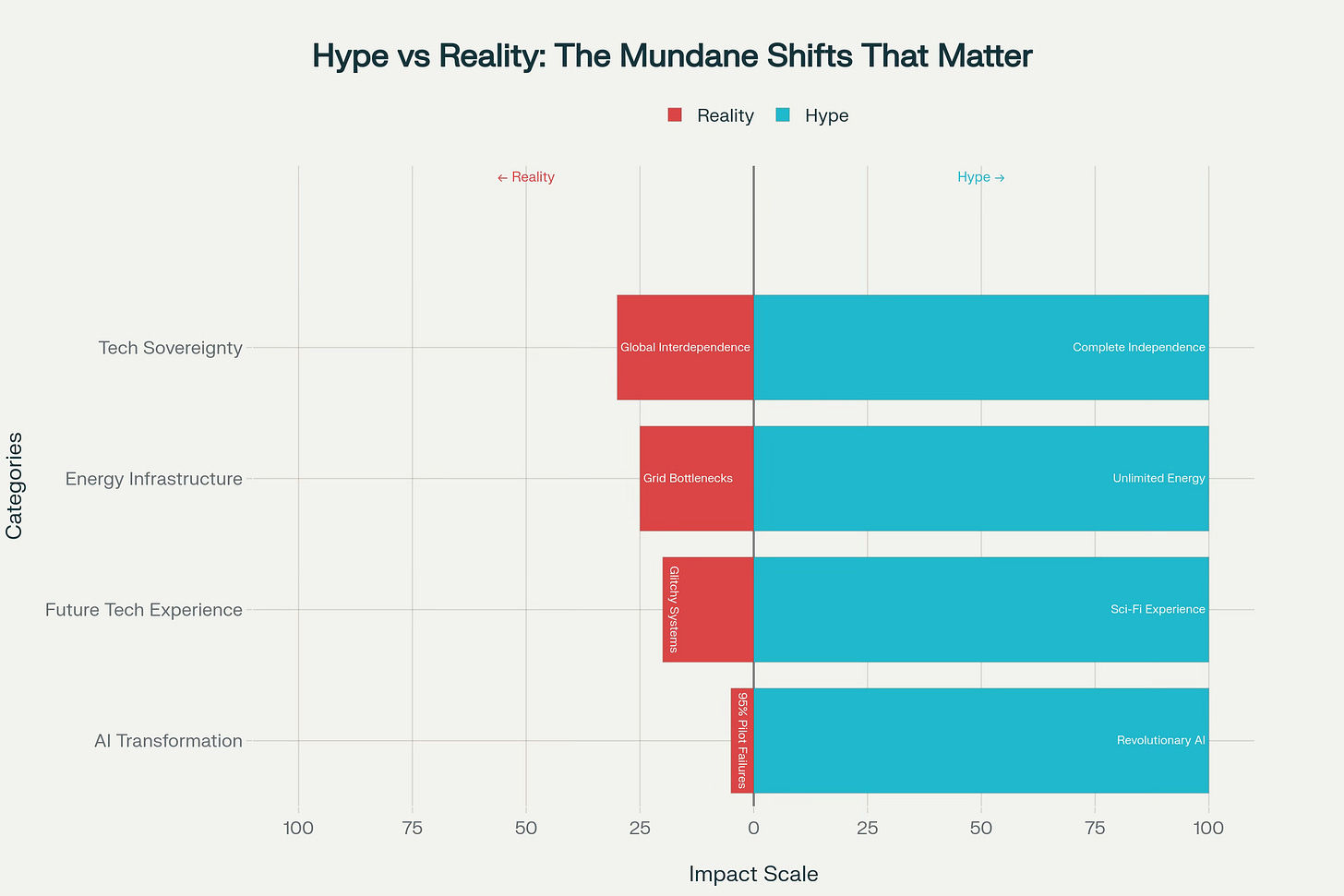

Future Thinking: Nick Foster (ex-Google X) warns against sci-fi fantasies of the future, urging focus on “mundane shifts.”

AI: From Hype to Hard Tech, with Limits in Sight

Silicon Valley’s pivot to hard tech (supercomputers, defense AI, and infrastructure) confirms the trend I’ve highlighted before: elite human talent remains paradoxically scarce even as AI promises to automate vast amounts of knowledge work. Yet despite record spending ($375B this year, $500B projected next) OpenAI and Meta’s latest models suggest a plateau. The 95% failure rate of custom AI pilots shows that execution, not ambition, is the real bottleneck.

Nick Foster would call this a reminder of reality’s “ordinary shifts.” Taco Bell’s struggles with glitchy AI drive-thru systems are not the stuff of Jetsons-like futures, but mundane problems of customer tolerance, integration costs, and retraining staff. Even transformative tools settle into everyday life: Google’s Pixel 10 features real-time translation and camera coaching, practical enhancements that make life feel ordinary, not sci-fi.

What this means for Operators: Approach AI as augmentation, not replacement. Focus on proven ROI applications. Recall my earlier piece on The AI-Worker Alignment Crisis, workers adopt AI best when it feels like partnership, not substitution.

Energy Demands & Politicized Infrastructure

AI’s staggering energy appetite, 25GW more U.S. demand by 2026, underscores a recurring theme: technology only creates value when infrastructure keeps pace. The new wave of “patriotic capitalism,” with the government taking equity stakes in firms like Intel, highlights how incentives are shifting from efficiency to national security. For operators, this means the constraint on scaling AI may not be GPUs, but the grid, and the politics of who gets access to scarce power.

This too reflects Foster’s point: instead of “superintelligence,” the mundane realities of cost overruns, grid bottlenecks, and local opposition shape the pace of adoption.

What this means for Operators: Expect energy to be a core strategic constraint. In my earlier essay Bad Bad Bad (Data) Good Better Best (Data), I argued that infrastructure and inputs often define outcomes more than software. Consider localized power solutions or partnerships to secure supply.

Consumer Thrift Returns

Keep reading with a 7-day free trial

Subscribe to Operating by John Brewton to keep reading this post and get 7 days of free access to the full post archives.